In today’s business landscape, ESG (Environmental, Social, and Governance) is a strategic priority. Yet, despite growing awareness and public commitments, many organisations are falling short of meaningful ESG progress. Why? Because its governance structures needed to support these ambitions are often missing, fragmented, or underpowered.

Organisations that embed strong governance principles into their operations are far more likely to deliver on their ESG goals, and contribute positively to both society and the environment. But before we explore how governance can drive sustainability, we need to confront the uncomfortable truth: there’s a widening gap between ESG intent and ESG action.

Where Boards Fall Short on ESG Governance

Despite mounting pressure from regulators, institutional investors, and socially conscious stakeholders, many boards are still struggling to operationalise ESG governance effectively.

Despite mounting pressure from regulators, institutional investors, and socially conscious stakeholders, many boards are still struggling to operationalise ESG governance effectively.

The problem isn’t simply lack of ambition, it often tends to be lack of infrastructure.

Here’s where the cracks typically appear:

- Fragmented ESG oversight: ESG responsibilities are often dispersed across committees and departments, with no unified governance framework to guide decision-making.

- Poor visibility and traceability: ESG-related discussions, votes, and policies are buried in emails, spreadsheets, or disconnected systems, making it nearly impossible to audit or report with confidence.

- Limited integration with strategic planning: Without a centralised platform to manage board workflows, ESG priorities often remain disconnected from broader governance and risk agendas, making it harder to embed sustainability into long-term decision-making.

These governance gaps slow progress, and expose organisations to regulatory scrutiny, investor dissatisfaction, and public backlash. To close the ESG execution gap, boards must modernise how they manage, monitor, and align ESG efforts with core governance processes.

Why Integrated Governance Matters

For ESG to deliver real value, boards need (yes, good intentions), but importantly, robust systems that support consistent oversight and strategic alignment.

For ESG to deliver real value, boards need (yes, good intentions), but importantly, robust systems that support consistent oversight and strategic alignment.

Directors are increasingly expected to understand ESG risks, monitor progress, and ensure accountability across the organisation.

But without integrated governance, these responsibilities become difficult to fulfil. Here’s what you need to know.

The 3 Pillars of Effective ESG Governance

1. Transparency

Boards must be able to access clear records of discussions, decisions, and follow-ups, especially when ESG issues are on the agenda.

2. Accountability

Directors need visibility into ESG-related commitments, voting outcomes, and performance indicators to ensure progress is being tracked and reported.

3. Alignment

ESG priorities should be embedded into broader governance frameworks so that sustainability goals are reflected in long-term planning and risk management.

Yet many boards are still struggling to connect sustainability with business strategy and investment. According to PwC’s 2024 Annual Corporate Directors Survey, only 14% of directors understand how their climate commitments influence capital allocation decisions, and just 27% believe climate change is embedded in their value creation strategy.

A major barrier is lack of control and visibility. Fewer than 25% of directors feel confident in the accuracy of their company’s sustainability reporting or have clear oversight of its net zero plan. Without integrated governance tools, boards risk making decisions based on incomplete or outdated information, undermining both ESG credibility and strategic resilience.

The Rising Stakes for ESG Governance

In Australia and New Zealand (as well as many regions globally), ESG governance is a present-day imperative. Regulatory bodies and investors are raising expectations, and boards are under increasing pressure to demonstrate credible oversight of sustainability risks and opportunities.

In Australia, the Australian Securities and Investments Commission (ASIC) has warned directors that greenwashing and poor ESG disclosures could lead to enforcement action. The regulator has already taken steps against companies for misleading sustainability claims, signalling that ESG governance must be backed by robust documentation and board-level accountability

Meanwhile in New Zealand (in 2021) became the first country to mandate climate-related financial disclosures for large listed companies, banks, insurers, and investment managers through the Financial Sector (Climate-related Disclosures and Other Matters) Amendment Act. Learn more here.

This means, directors must move beyond surface-level ESG commitments. Without clear governance frameworks and reliable data, boards risk falling short of compliance, losing investor trust, and missing opportunities to create long-term value.

How StellarBoard Closes the Gap

StellarBoard helps boards bring structure and clarity to ESG governance.

StellarBoard helps boards bring structure and clarity to ESG governance.

Our platform is designed to support directors in managing board responsibilities with greater confidence and control.

Key Features To Improve Governance Include:

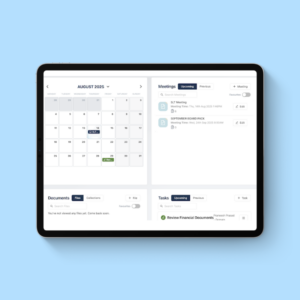

- A centralised portal for board activity: Directors can access agendas, minutes, votes, ESG policies, and supporting documents in one secure location.

- Real-time visibility into governance workflows: With everything in one place, boards can make informed decisions and maintain continuity across meetings.

- Audit-ready documentation: Every action is traceable, helping boards meet compliance obligations and demonstrate accountability to stakeholders.

Whether your board is addressing climate risk, social impact, or governance reform, StellarBoard provides the infrastructure to support effective oversight and strategic alignment. It’s about enabling directors to lead with clarity, not chasing down fragmented information.

Explore how StellarBoard can support your board’s ESG journey at www.stellarboard.com